5 Hidden Costs of Manual Mortgage Compliance

And Why Lenders Lose Millions Before the Audit Even Begins

The mortgage industry talks often about audit findings, remediation plans, and regulatory enforcement — but far less about the operational bleeding that happens long before an auditor ever steps through the door.

In 2026, compliance isn't failing because teams lack expertise. It's failing because the manual processes the industry still relies on are fundamentally too slow, too fragmented, and too costly to sustain.

This guide breaks down the five hidden costs of manual mortgage compliance — and why automation, regulatory intelligence, and digital rules must become the industry standard.

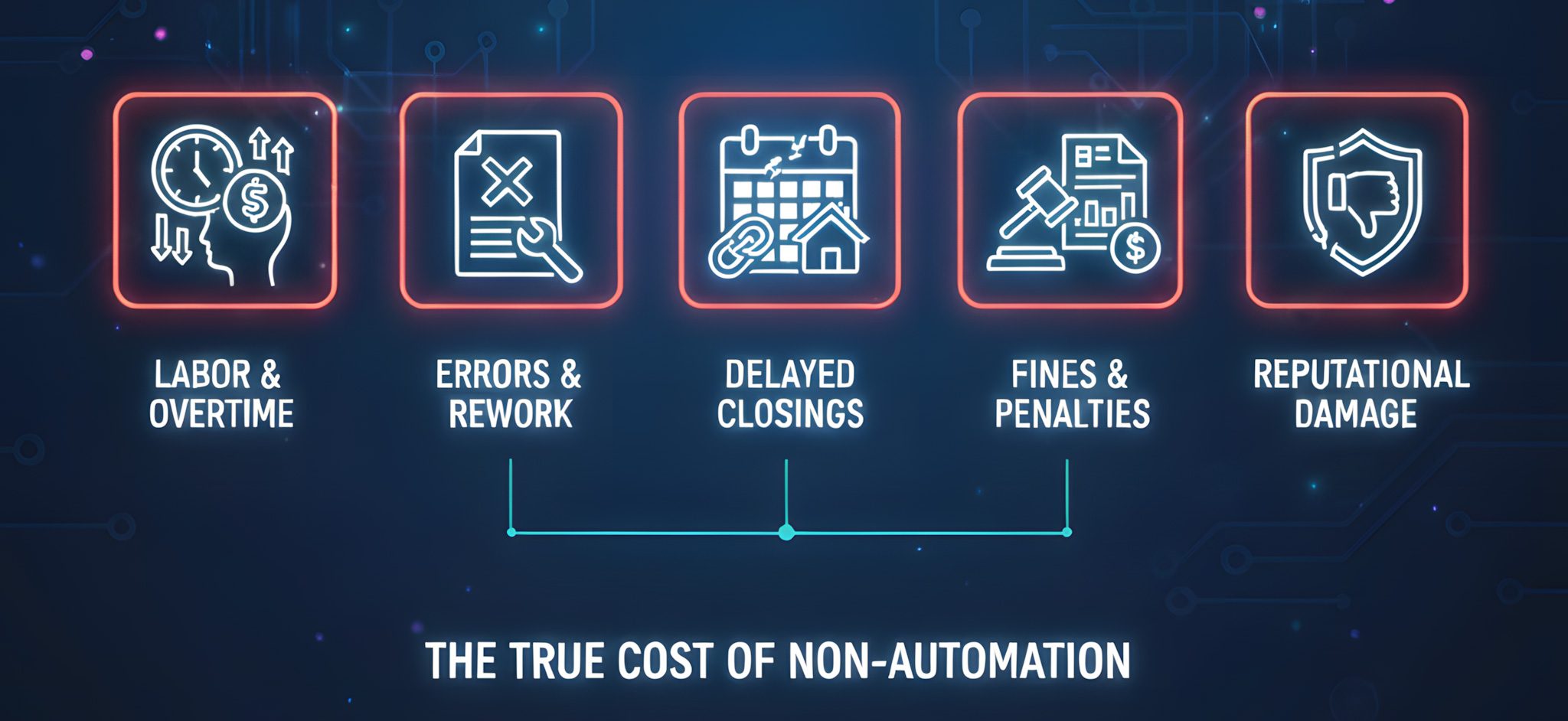

Lenders lose millions each year in:

- ⏱️ Inefficient regulatory monitoring

- 🔁 Repetitive manual interpretations

- ⏳ Delayed adoption of new rules

- 📋 Audit prep that takes weeks

- 📉 Repurchase exposure from missed updates

These losses aren't always visible on a balance sheet — but they quietly erode profitability, increase risk, and drain staff capacity.

Time-Heavy Regulatory Monitoring

The Detective Work No One SeesMortgage regulations don't come from one source — they come from dozens.

- 🏛️ CFPB

- 🏠 HUD

- 🏦 FHFA

- 🏢 OCC

- 💼 FDIC

- 📊 Fannie Mae

- 📈 Freddie Mac

- 🗺️ 50+ state regulators

- 🏘️ County-level ordinances in certain jurisdictions

Each publishes updates differently, and many state agencies:

- ❌ Don't announce changes

- 📄 Don't maintain version history

- 🔄 Replace PDFs silently

- 🧩 Scatter requirements across multiple pages

This forces compliance teams to:

- 🌐 Check 20–30 websites manually

- 🔍 Review PDFs for small edits

- 📊 Track changes using spreadsheets

- ⏰ Compare timelines manually across states

It's not "monitoring" — it's regulatory detective work.

In many institutions, two or three FTEs spend 20–30 hours a week just checking for updates.

A regulatory index eliminates this burden entirely by monitoring, detecting, comparing, and archiving changes automatically.

Internal Interpretation Discrepancies

When Two People Read the Same Rule DifferentlyTwo compliance officers can read the same regulation and interpret it differently — and this happens everywhere.

The Result:

- 🏢 Different departments use different definitions

- 👥 Loan teams, auditors, and QC all apply rules differently

- 📜 Policies drift out of sync

- 📋 Audit templates are inconsistent

- 📊 Findings multiply because no one is aligned

This is one of the largest hidden expenses in the industry. Manual interpretation creates:

Teams spend hours debating what a rule means.

Each department builds their own version.

Audits reveal the inconsistencies too late.

Alignment slows down every new requirement.

Digital rules eliminate interpretation variance by converting legal text into consistent, machine-readable logic.

Slowed Production and Pipeline Drag

Every Exception Slows Down a LoanWhen rules are manually interpreted, manually validated, manually tracked, and manually remediated — loan pipelines slow down, especially during peak seasons.

The Impact:

- ⏱️ Turn times increase

- 👤 Borrowers experience delays

- 📅 Secondary market deadlines are missed

- 📄 Ops teams burn hours manually chasing documents

- 💰 Cost per loan rises across the board

According to MBA's 2025 study, operational inefficiencies were one of the primary contributors to rising cost per loan nationwide.

Source: Mortgage Bankers Association — Performance ReportsAutomated rule validation drastically reduces exception counts and accelerates the pipeline.

Audit Preparation That Takes Weeks

Instead of MinutesMost lenders still prepare for audits by:

- 🔍 Searching for documents

- 💾 Downloading files from LOS/Servicing systems

- 📊 Cross-referencing spreadsheets

- 📸 Pulling screenshots

- ⏰ Manually recreating timelines

- 📝 Explaining version discrepancies

- 🎲 Reviewing random sample loans manually

A Single Audit Cycle Can Cost:

- ⏱️ Hundreds of hours of labor

- 💰 Tens of thousands in overtime

- 👔 Even more if external consultants are needed

Manual prep is one of the industry's worst-hidden drains.

With automation, lenders can reduce audit prep from weeks to minutes.

Repurchase Risk From Missed Updates

The Most Expensive Failures Show Up LaterThe most expensive compliance failures don't show up during supervision — they show up during loan file reviews, QC audits, and investor due diligence.

Why? Because missed updates lead to:

- 📄 Incorrect disclosures

- ⏰ Mistimed notices

- 📝 Outdated forms

- 🧮 Inaccurate calculations

- 🗺️ Violations of state-specific requirements

Even a Minor Missed Update Can Escalate Into:

- ⚠️ Loan defects

- 📉 File downgrades

- 💸 Repurchase demands

- ⚖️ Monetary penalties

- 📰 Severe reputational damage

This is preventable — if institutions stop relying on manual processes and adopt automated regulatory change intelligence.

How ARC Eliminates All 5 Hidden Costs

ARC by VeritIQ was built specifically to solve these root causes.

ARC Automatically Delivers:

- ✓ A centralized regulatory index

- ✓ Automatic change detection

- ✓ Silent update monitoring

- ✓ Version-controlled rule history

- ✓ Digital rule logic

- ✓ Automated validation

- ✓ Audit-ready evidence trails

The Cost Savings Are Immediate and Significant:

- ✓ 80–95% reduction in regulatory monitoring workload

- ✓ Faster adoption of state/federal changes

- ✓ Consistent interpretations across all departments

- ✓ Shorter audit cycles

- ✓ Lower repurchase exposure

- ✓ Stronger operational control

The Real ROI: Compliance That Pays for Itself

Manual compliance is slow, inconsistent, and expensive. Automated compliance reduces error rates, speeds up loan production, lowers audit risk, cuts labor costs, improves borrower experience, and strengthens regulatory alignment. The ROI isn't theoretical — it's measurable.

Stop Losing Money Before the Audit Starts

The hidden costs of manual mortgage compliance aren't small operational inefficiencies — they're major financial liabilities.

Lenders Who Modernize Now Will:

- ✓ Reduce audit findings

- ✓ Lower repurchase risk

- ✓ Improve loan quality

- ✓ Automate supervision

- ✓ Scale with confidence

Lenders who don't will continue absorbing silent, compounding, preventable losses.