Not a single manual audit questionnaire was designed for the world we work in today

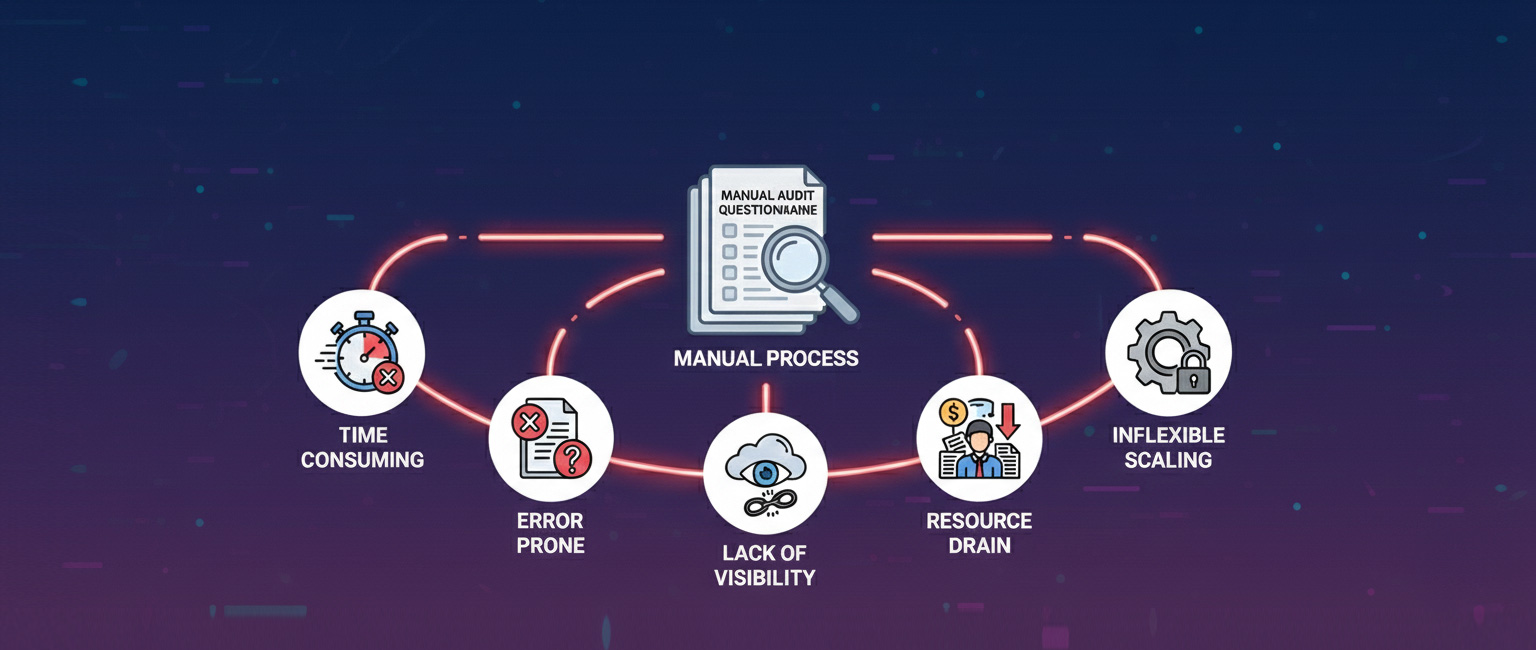

Manual audit questionnaires break under their own complexity. Here's why—and what modern teams need instead.

What started decades ago as a simple checklist has ballooned into a sprawling, fragile system of human-written questions struggling to keep pace with regulatory complexity, operational scale, and the demands of modern mortgage compliance.

Compliance teams feel the weight of it every day: too many questions, too little structure, and too much manual effort in a world that's moving faster than ever.

This is the quiet operational crisis inside every audit department, and it’s an issue we’ve spent years developing a solution for - let's talk about it.

📊 The Scaling Problem No One Planned For

In theory, a manual audit questionnaire should be straightforward: read a regulation, turn the requirement into a question, and repeat.

In practice, the volume is overwhelming.

During a typical mortgage audit, the number of required questions varies dramatically:

No team, no matter how experienced, can manually maintain a question set of this size without creating inconsistencies or missing critical updates. And no auditor can move through hundreds or thousands of questions without experiencing fatigue, frustration, or reduced accuracy.

The system isn't just strained. It's fundamentally mismatched to the scale of modern compliance.

⚠️ Where a Manual Audit Questionnaire Begins to Break

Over the last couple decades working these issues, we've noticed that cracks usually appear in the same places.

📝 Questions Become Too Broad

When humans try to limit volume, nuances disappear. A single question often attempts to capture multiple regulatory requirements — making it vague and open to interpretation.

🎭 Phrasing Becomes Inconsistent

Different authors write differently. Over time, the manual audit questionnaire becomes a patchwork of voices, styles, and answer choices. This inconsistency creates downstream QC issues and increases training time.

🔧 Maintenance Becomes Impossible

Each regulatory update triggers a domino effect affecting:

- 📝 Question wording

- 🎯 Applicability

- 🔀 Branching logic

- 📊 Scoring

- ⚠️ Exception definitions

A single change can impact dozens of questions, and a manual audit questionnaire cannot reconcile these relationships quickly or safely.

😓 Auditor Fatigue Leads to Real Risk

Endless scrolling, unclear progress, and repetitive or irrelevant questions create audits that feel like they never end. These are partially UX failures and aren't just an inconvenience — they reduce accuracy and increase the likelihood of missed findings.

We solved this issue by creating an interactive dashboard, where users can toggle between audits, risks, and compliance items.

🔒 The Hidden Issue: A Manual Audit Questionnaire Can't Adapt

❌ Static questionnaires assume:

- ✕ The same questions apply to every loan

- ✕ Answers always move linearly

- ✕ Relevance stays constant

But mortgage compliance isn't static or linear. It's conditional.

A single loan field — loan type, property type, credit threshold — can change the entire shape of the questionnaire. Manual tools were never designed for that level of adaptiveness.

The problem is not human effort. The problem is architecture.

✨ What Modern Compliance Teams Need Instead

The industry is shifting toward adaptive, data-driven, AI-assisted audit architecture — something a manual audit questionnaire could never support.

Adaptive Questionnaires

Questions should appear or disappear based on:

- ✓ Loan characteristics

- ✓ Prior answers

- ✓ Audit type

- ✓ Exception triggers

Auditors should see only what is relevant and nothing more.

Hierarchical Question Design

Each question must trace cleanly back to:

regulation → requirement → question → answer → exception logic

This structure strengthens defensibility during exams.

AI-Assisted Maintenance

Automation should help:

- ✓ Update question sets

- ✓ Revise branching logic

- ✓ Add new conditional paths

- ✓ Maintain consistency

This is the only scalable way to keep pace with regulatory change.

Data-Driven Criteria

Logic should reference standardized schemas, not proprietary field names — enabling broad adaptability without brittle workflows.

🎯 Why This Matters Now

Compliance volume is increasing, and regulators expect more precision.

"Supervision continues to find failures to accurately maintain and transmit information required for servicing rules... Institutions must have systems that produce precise, complete, and reviewable data to comply with Regulation X."

Nonbank lenders face examinations once reserved only for large institutions. The cost of errors — operationally and financially — is higher than ever.

Manual questionnaires aren't just inefficient. They're a liability.

The Future of Audit Architecture

The organizations that thrive will be the ones who shift from static questionnaires to adaptive, AI-backed audit architecture.

This is the foundation of what comes next, and what fuelled the drive to create a platform with the capabilities of ARC.

Modern compliance requires modern tools — and ARC by VeritIQ delivers exactly that.