- Solutions

- Resources

- Solutions

- Resources

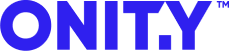

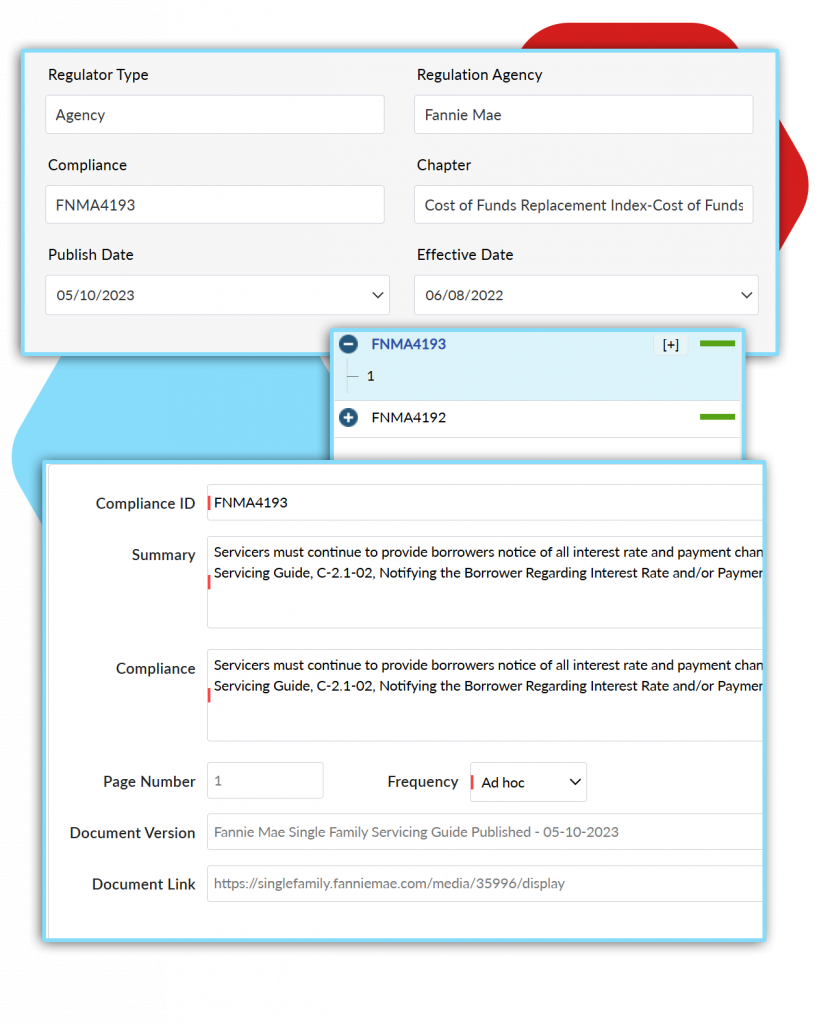

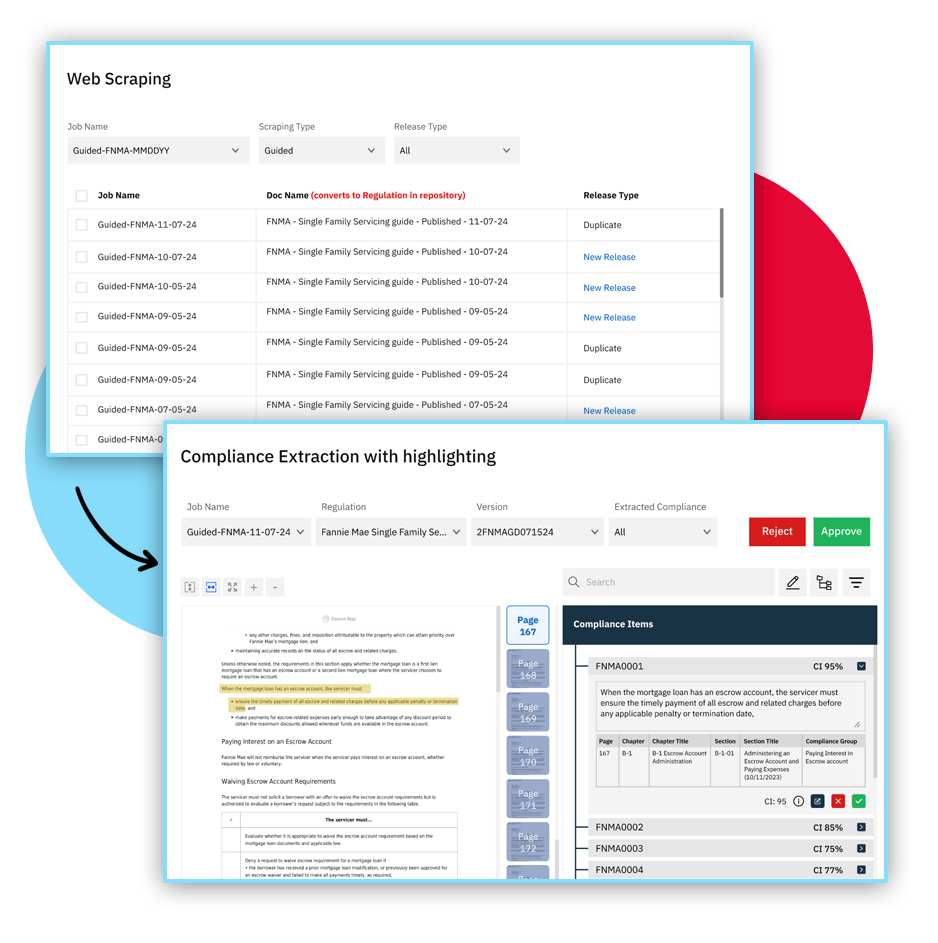

ARC by VeritiQ is a SaaS platform designed for operational risk management, compliance, and audit functions. Developed primarily for B2B markets, ARC aids organizations—especially those in heavily regulated industries like finance, insurance, and mortgage services—in managing complex compliance requirements and mitigating operational risks. The platform offers features for tracking, reporting, and assessing risk across various organizational levels, which is essential for ensuring adherence to regulatory standards.

How ARC Enhances Audits, Risk, and Compliance Management.

Reduce the time and effort required to resolve audits with automation.

Double your effectiveness in identifying and managing operational risks with real-time insights.

Improve compliance processes by automating complex workflows and ensuring accuracy.

To empower organizations in highly regulated industries by delivering innovative, user-friendly solutions that simplify risk management, ensure compliance, and optimize operational efficiency. ARC by VeritiQ is committed to supporting our clients in achieving compliance excellence and operational resilience through real-time insights, streamlined workflows, and proactive risk assessment tools.

To be the leading catalyst for operational integrity and efficiency in regulated industries, where organizations can confidently navigate compliance and risk with agility and foresight, powered by seamless, intelligent technology.

Souren Sarkar is the founder and CEO of Nexval, with a career that spans over 25 years in technology, particularly in the mortgage and financial services industries. He began his journey in tech with Bayview Financial in 1996, where he eventually rose to the position of Chief Technology Officer. Later, Sarkar ventured into entrepreneurship, establishing Nexval as a company that emphasizes innovation in mortgage process automation, compliance, and IT solutions.

Under his leadership, Nexval has grown into a significant player in mortgage technology, providing advanced solutions for document automation, AI-driven compliance, and outsourcing services. Sarkar is particularly known for advocating for AI and machine learning within mortgage operations, seeing them as essential to addressing the limitations of legacy systems and optimizing data access and compliance.

Unlike many rigid compliance systems, ARC is designed to be intuitive and adaptable to diverse regulatory environments. This means companies can configure it to meet specific compliance needs without overwhelming users with a steep learning curve or requiring excessive customization.

ARC is an easy-to-use compliance management and operational risk management platform designed to meet your specific business needs. This all-in-one solution streamlines QC, QA, and risk workflows efficiently, ensuring that your organization stays audit-ready and ahead of potential risks.