In today’s fast-evolving regulatory landscape, compliance teams face increasing pressure to maintain accuracy, efficiency, and adaptability. Traditional manual processes often fall short...

- Solutions

- Resources

- Solutions

- Resources

The Ultimate Guide to Mortgage Compliance in 2026 | VeritIQ Blog Mortgage Compliance Regulatory Intelligence RegTech Audit Automation Mortgage compliance in 2026 is driven by

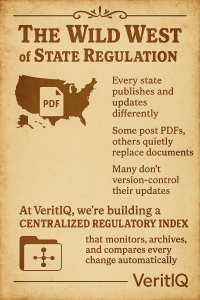

The Wild West of 60+ State Mortgage Regulatory Agencies | VeritIQ Blog State Regulatory Intelligence The Chaos of State Mortgage Regulatory Agencies Federal regulators may

5 Ways Digital Rules Transform Your Compliance Management System | VeritIQ Blog Regulatory Intelligence & Automation, Compliance Management System 5 Ways Digital Rules Transform Your

5 Hidden Costs of Manual Mortgage Compliance | VeritIQ Blog Mortgage Compliance Regulatory Intelligence Audit Automation 5 Hidden Costs of Manual Mortgage Compliance And Why

Supply Chain Risk Management Software: Building Resilience | VeritIQ Blog Supply Chain Risk Management Regulatory Intelligence Automation Supply Chain Risk Management Software Building Resilience Through

Industrial Regulatory Compliance: Building Trust and Resilience in 2026 | VeritIQ Blog Industrial Compliance Regulatory Intelligence OSHA · EPA · NIST · FDA Industrial Regulatory

Top 7 Reasons Why the Mortgage Industry Needs a Centralized Regulatory Index | VeritIQ Blog Regulatory Intelligence Mortgage Compliance Why the Mortgage Industry Needs a

5 Critical Reasons Why a Manual Audit Questionnaire Fails at Scale | VeritIQ Blog Audit Automation Mortgage Compliance AI-Assisted Audits Not a single manual audit

Why Audit Management Software Automation Has Failed for 20 Years | VeritIQ Blog Audit Automation AI-Powered Compliance Industry Analysis Why Audit Management Software Automation Has

Audit Automation Tools: 7 Powerful Ways Hybrid Automation Transforms Compliance | VeritIQ Blog Audit Automation Tools Hybrid Automation AI + Human Intelligence Hybrid Automation Transforms

As regulatory requirements continue to evolve, organizations across industries are facing increased pressure to ensure compliance. The consequences of non-compliance-including fines,…

Operational risk management (ORM) has become a cornerstone for business resilience in today’s dynamic and interconnected world. As organizations face increasing uncertainties,…

ARC is an easy-to-use compliance management and operational risk management platform designed to meet your specific business needs. This all-in-one solution streamlines QC, QA, and risk workflows efficiently, ensuring that your organization stays audit-ready and ahead of potential risks.